The headline felt like a bit of hyperbole, until you consider more than two million people have fled Ukraine in the biggest refugee migration since World War II. The work being done by governments, NGOs and private citizens throughout Europe and beyond to absorb people and find them shelter is a herculean effort. There are still plenty of ways for people to donate and support their efforts.

As evidence of war crimes mounts by the day, the growing humanitarian crisis is spilling over into the pandemic-fueled and still pandemic-affected European supply chains. The purpose of this update is to touch on three distinct areas where we are seeing rapidly changing conditions—none for the better. We continue to reiterate (perhaps to the point of tone-deafness because there is only so loudly we can scream) that planning and securing space as early as possible is crucial to protecting the most critical of supply chain movements.

TOC Logistics has sea, air and trucking allocations from carriers who have committed and with whom we have contracted to move our clients’ cargo. But these allocations are finite in their space and capacity. The sooner we know what is required, the sooner we can begin making arrangements or seeking additional capacity.

Sea Freight: Capacity, Equipment, Costs, Imminent and Unannounced Blanked Sailings

We spoke in our last market advisory about the role that north European ports play as a gateway for Russian imports. Russia’s largest ocean export is empty containers, and European shippers are dependent upon that supply.

The embargoes mean that containers which have arrived—and continue to arrive—cannot be delivered, leaving them on terminals and reducing utilization. Setting aside the issues of payment for goods, detention and demurrage, the backlog, combined with the severe reduction in empties, further puts Europe in a precarious condition.

Vessels are already running between one and three weeks behind. Their schedules have become so erratic and sporadic that we have weeks with an overflow of capacity and weeks with none whatsoever. The growing backlogs at US east coast ports aren’t helping them get back on schedule.

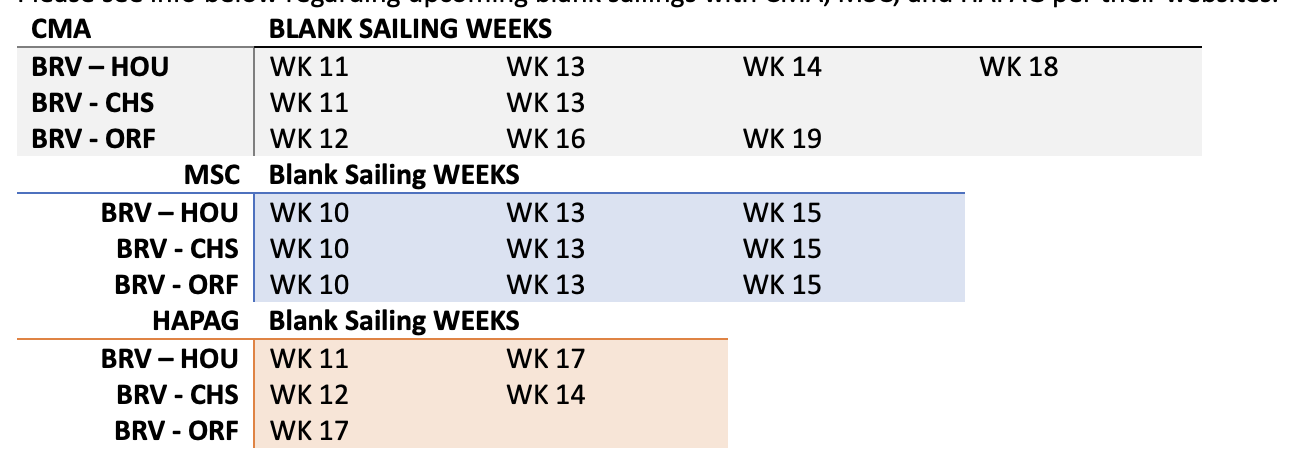

The delays, the vessels out of rotation on their fixed-day sailings strings and the lack of cargo have led many to throw up their hands and start blanking voyages. Our operations team collected this table of schedule changes from the carriers’ respective websites:

What is happening as well is that carriers who would call two US ports on a string—say the USEC and Gulf—are now alternating the calls on alternating weeks, so bi-weekly calls. With delays in places like Charleston and Houston running 7-8 days per port, carriers have made the choice to accept the loss of one week waiting to unload rather than two. At origin, however, this creates additional congestion on the terminal, and terminal operators will impose limitations on how early containers can be delivered prior to loading. More days out, more potential days of chassis rental and equipment demurrage.

As we observed between Asia and the USWC, rates have soared astronomically. A survey of our pricing teams revealed spot rates that are fully four times what they were this time a year ago.

Trucking: European truck fuel nearly $10.00/gallon, driver numbers dwindling

The Biden Administration has laid the increase in oil and, correspondingly, gasoline prices right at the feet of Russian President Putin, calling them “Putin’s price hikes.” Traders hate uncertainty, and there are few greater uncertainties than war.

In Europe, diesel fuel for trucks was EUR 1.23/l in January, 2021. Exchanged into dollars per gallon, the rate was $5.15. This week, with sanctions and countries either blocking or winding down purchases of Russian oil, combined with the war, fuel has topped EUR 2.36/l, or nearly $10.00 per gallon.

We anticipate inland haulage to continue to see increasing fuel surcharges and increasing costs because of the number of Ukrainian drivers who have left their commercial trucks to fight in the war. There is also continuing evidence that truckers in places like Poland are unable to fill their tanks entirely, effectively limiting their range.

Air freight: Reprising Asia—US/Europe rate increases, capacity reductions

When things were at their worst on the transpacific eastbound, shippers turned to air freight, mostly secured through freighters or the handful of carriers operating passenger flights or “phreighters.” European shippers and corresponding American buyers are doing the same now from Europe to fill critical gaps in supplies caused by the ocean freight problems we discussed above.

Rates are spiking, as reported here in The Loadstar, and allocations are booking weeks in advance. Unsurprisingly, airlines are imposing increasing fuel surcharges and war risk surcharges on both contract and non-contract business. The spot market for air freight right now is stratospheric.

The air freight challenges are being driven by a lack of passenger flights, the grounding of capacity in carriers such as Aeroflot and AirBridge Cargo, the additional transit time because of bans of Russian airspace (affecting cargo moving mostly from India via Europe) and freighters being snapped up for war materiel and humanitarian missions.

TOC Logistics continues to work hard for our customers

TOC Logistics and ProTrans remind our customers that we have been in business for many years and have built up long and stable relationships with the vendors who move our customers’ cargo. We cannot guarantee success for each shipment, but we are drawing on the experience of our years in business and the past two years navigating pandemic-related challenges to deploy those skills to face this new challenge.

We are your supply chain’s best resource to navigate this archipelago of challenging times. Stay in constant contact with us, as we are with you, to focus on delivering the most successful outcomes during this time of uncertainty.